We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Written by

Sarah Foster

Principal writer Sarah Foster covers the Federal Reserve, the U.S. economy and economic policy for Bankrate, where she helps readers understand how the world’s most powerful policymakers in Washington, D.C., impact their personal finances. She’s covered the Federal Reserve and U.S. economy since 2018, when she joined the economics news team at Bloomberg News.

Edited by

Brian Beers

Brian Beers is the managing editor for the Wealth team at Bankrate. He oversees editorial coverage of banking, investing, the economy and all things money.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Bankrate logoFounded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most — how to save for retirement, understanding the types of accounts, how to choose investments and more — so you can feel confident when planning for your future.

Bankrate logoBankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Bankrate logoYou have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

If you’re one of the millions of Americans exempt from filing a tax return in 2020, you’re still eligible for a $1,400 (or more) coronavirus stimulus check – and now’s the time to claim it.

Relief might soon be on the way, after the Internal Revenue Service (IRS) on Tuesday announced that so-called “non-filers” will begin receiving their Economic Impact Payments (EIP) on April 7.

That announcement comes after a nearly month-long wait for the group, which includes Social Security survivor, retirement or disability recipients, Railroad Retirement Board (RRB) beneficiaries, Supplemental Security Income (SSI) grantees and ultra low-income individuals. The IRS began distributing the third round of stimulus checks on March 12, a day after President Joe Biden signed the $1.9 trillion American Rescue Plan into law.

“IRS employees are working tirelessly to once again deliver Economic Impact Payments to the nation’s taxpayers as quickly as possible,” said IRS Commissioner Chuck Rettig. “We know how important these payments are, and we are doing everything we can to make these payments as fast as possible to these important individuals.”

Here’s everything you need to know about claiming your $1,400 (or more) amount and what steps you should take if you don’t receive the entire amount for which you’re eligible.

Not everyone has to submit a tax return, which might come as a surprise to many Americans.

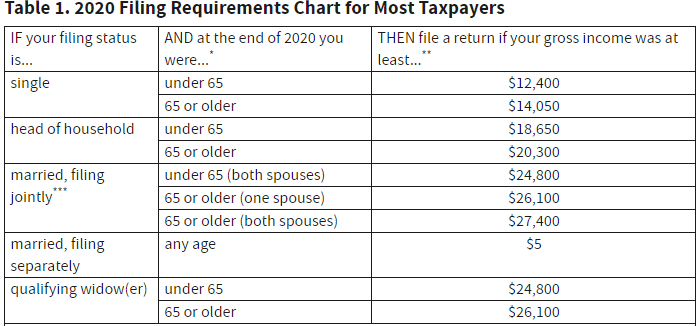

Those who make less than the standard deduction – which differs based on your gross income, filing status and age – generally wouldn’t need to file a tax return.

For 2020, if you were single and under age 65, you wouldn’t have to file a return if your income was less than $12,400. If you’re single and 65 or older, you wouldn’t have to submit a return if your income is less than $14,050. Married couples under age 65 filing jointly wouldn’t have to file a joint return if they earned less than a combined $24,080. Heads of households under age 65, meanwhile, wouldn’t have to submit a tax return if they earned less than $18,650.

That’s based on your gross income, which means all the non-tax exempt earnings you receive in the form of money, goods, property and services. Income could be from sources outside the United States or from the sale of your main home. Social Security and other federal retirement benefits, however, don’t count — most of the time.

Some special circumstances might require you to file a return. You would count your Social Security benefits as income if you’re a beneficiary who’s married but filing a separate return even though you live with your spouse. If one-half of your Social Security benefits plus your other gross income and tax-exempt interest is more than $25,000 (or $32,000 if you’re married filing jointly), you would also count that money, according to the IRS.

Individuals who, for example, sold any investments or had self-employment income would have to file a return regardless of their income or filing status.

Non-filers will be able to obtain their stimulus checks the same way other recipients could: via direct deposit, mailed physical check or debit card. Some recipients could also receive their payment on a “Direct Express” card, which is sometimes used to distribute federal benefits. Once your payment has been processed, you can track your stimulus check through the IRS’ Get My Payment tool.

A large proportion of non-filers are most likely federal retirement or disability beneficiaries. For those individuals, the IRS will most likely already know where to send your payment, as the IRS is now tapping into data from other federal agencies. For example, if you receive Social Security through a direct deposit, the IRS will likely already have been granted access to your information through the Social Security Administration (SSA). Non-filers may have already provided the IRS with their information in an earlier stimulus check round, when the agency had a portal for inputting bank account information.

The number of low-income Americans who don’t submit a tax return is likely low, according to Eric Bronnenkant, CPA, head of tax at Betterment.

“Many of those people typically file, even though they may not be required, to just get the refund,” he says. “The IRS should already have a lot of the information.”

Yet, say you’re an individual who has never submitted a tax return. In this instance, tax experts say you’d want to file a 2020 return – and quickly, to ensure you get your hands on your refund or stimulus check as soon as possible. The IRS will most likely send checks first to those who have provided direct deposit information. Doing so could make sure you beat the rush of filers who will undoubtedly wait up until the new May 17 deadline.

While every circumstance is different, experts also agree more broadly that submitting a tax return is good practice to ensure you don’t miss out on any tax breaks or credits that could increase your refund, particularly if you have dependents. You can use the IRS’ free-filing tool.

“There’s this misconception out there that if you don’t make more than $12,400, you just don’t do it,” says Tony Molina, CPA, a senior product specialist at Wealthfront. “Even if you’re making very little income, single or married, there’s a pretty good chance that filing this year, you’re going to get some kind of credit or stimulus check back.”

You can retroactively claim any missing stimulus check by claiming a Recovery Rebate Credit. Be sure to calculate how much you’re eligible to receive, including adult dependents thanks to new eligibility expansions in the third stimulus check round. If you didn’t receive any or all of your designated amount, be sure to claim it.

That’s a necessary step that goes even beyond non-filers. Say your income was higher in 2019 than it was in 2020, altering your eligibility for a stimulus payment. You’ll also want to claim your missing stimulus money by taking advantage of the Recovery Rebate Credit, which will only increase your refund or reduce what you owe.

Perhaps you followed all the right protocols and are still waiting for a check. Experts advise to first be patient. The delivery process could potentially take weeks, especially if you were mailed a physical check. A complicated and busy tax season could also potentially delay how quickly the IRS can process each return, with the IRS’ Rettig warning on multiple occasions of limited resources and staff.

“First check under the status on Get My Payment,” Bronnenkant says. “It may be that they haven’t gotten around to sending your payment yet.”

Tax experts are also bracing for the Recovery Rebate Credit’s return during next year’s tax season. Bronnenkant calls it a “worst-case scenario,” but taxpayers will most likely be able to use it to recover their third payment worth $1,400 or more and the second stimulus check worth at least $600 if either of them are still missing.

After the new May 17 filing deadline passes, Molina says he can see a scenario in which the IRS opens up a portal to help Americans claim their missing stimulus check if enough people are still concerned or experiencing delays.

“It’s a confusing time, not just for non-filers, but for those regular filers determining what they’re eligible for,” Molina says. “Do everything you can in terms of getting your info on the IRS website, but if you’re not getting the check right away and the IRS info isn’t working, you may have to be patient this time around. The money will arrive.”